my bet is: as long as we need to completely transition to renewable transport, because everything we eat, build and wear needs to be transported and most of us don’t work from home or study from home:

oil prices are high because that’s what putin can use as leverage against the developed world after his failed annexation of Ukraine and it’s clear he’d rather die than accept Ukraine is an independent country. Global warming makes a transition to renewable energy inescapable and even if putin died today and Russia opened the taps again, it would only slow down the transition.

But holy shit, it’s gonna be hard and expensive, it’s going to take decades and every populist politician of both left and right is going to fight it. My bet is 2 decades.

What do you think?

Until we eat the rich, in public, en masse.

A good rump roast and ale!

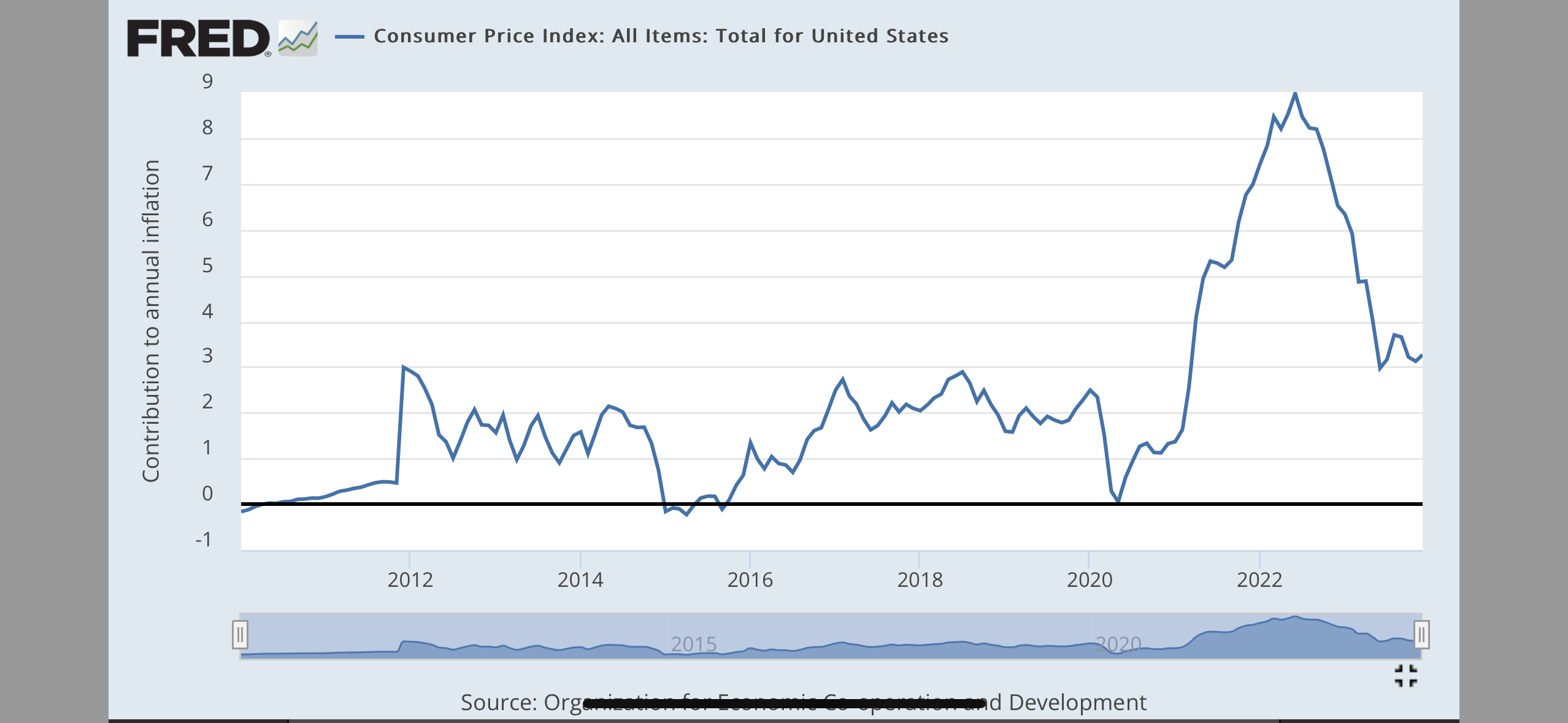

The inflation that started towards the end of the pandemic shutdowns is essentially over now in the U.S. according to the most widely used measures.

There’s a lot of ways economists measure inflation. That chart is for all items. Policy makers usually use “core” inflation, which excludes food and energy. Food and energy prices are obviously important to individuals but they’re volatile and can add a lot of noise. (Like gas prices go up and down all the time without it meaning the Federal Reserve needs to change long term policy.)

Another caveat is that shelter lags behind by about 6 months just because of (a) how it’s measured and (b) people sign leases once or twice a year. So, if the main reason inflation is up or down is housing, it could be misleading about actual inflation right now.

Anything between 1% and 3% with low unemployment is fine and that’s where the U.S. is now. Other countries may not be there yet but this is nothing like the late 70’s and early 80’s.

If prices don’t decrease and wages don’t increase (as a median, not average), inflation “ending” makes no difference.

Who gives a fuck it inflation “is over” if I’m still paying more for the same shit and making the same amount of money?

Unless things change, it looks like it’s already over. Oil prices aren’t really that high right now, US production is setting records so that’s really offset the supply issues from other producers. Gas prices at the pump are about as low as they’ve been since the bottom during lockdown, at least in the US. I agree the transition away from oil is going to likely increase energy costs to some extent but the recent inflationary period is unrelated to that I think.

Now we all just have to recalibrate our price expectations to 2020 prices x 1.5 or whatever it settled out as. Oh, and we’ve all gotta go find new jobs at the higher rates or we’re all poorer.

(We’re talking US only, right?) Isn’t the inflation already at 3.5%? The goal is usually around 2%. If the government wants they can get it to 2% by taxing extra corporate profits but even if they don’t do it and it will stay at 3% I don’t know if it’s an ‘era of inflation’. It could still be back to ~2% in a year or two if there’s no new war in the middle east. Now, looking at what’s happening in the middle east my bet is that there will be another war, the inflation will go up again (~10%?) and we’ll be stuck in this cycle until global economy splits and isn’t affected so much by local conflicts. You can already see this happening post war in Ukraine but it will take a decade or two. So I would say 1-2 years if manage to avoid another war, 10-20 if the current trend continues.

Yeah, the current era is already on the way out. Maybe a new one will begin, though. Even probably, at least for Gulf-reliant Europe, looking at how the Middle East is currently being mishandled.

If I had to guess… until the revolution.

oil prices are high because that’s what putin can use as leverage against the developed world after his failed annexation of Ukraine and it’s clear he’d rather die than accept Ukraine is an independent country.

… is this “Putin” in the room with us right now?

Monopoly capitalism is the driving force here. Collusion in pricing via algorithm, and lack of regulation means they can charge whatever they want, especially for essentials like eggs. It’s the fundamental contradiction, charge more but pay workers less. So everyone is deficit spending now and the balloon will pop

Eggs aren’t essential. Many people don’t eat eggs and are just fine. Food in general, is essential, but no specific food is.

It’s not a lack of government regulation, but rather a lack of competition that allows them to charge what they like.

Prices are naturally regulated by markets, when competition exists. But the government forcibly shut down a lot of the companies, forcing market consolidation. This means less competition.

Monopolies are a lack of competition. By definition. We need to encourage the starting of new businesses in existing industries if we want to solve monopolistic price fixing. Small businesses failed and got absorbed by larger businesses during the pandemic.

The new businesses that came into those spots are more likely to be big chains, companies with lots of cash reserves.

It’ll slow down now as the market fractures and evolves a new foam structure. For a while we had only big bubbles but small ones are always forming. As they grow into the places the previous small bubbles filled, the price rises will slow down.

What do you think?

There is no “current era”. It will be like this forever now.

Inflation has cooled, but that doesn’t mean prices go down. They most certainly will not. In fact much of the price gouging was due to corporations colluding or leveraging monopolies to raise prices across the board, since they aren’t beholden to any real regulation with teeth.

So, I suppose it “ends” when employers give pay raises commensurate with the pricing increases. Don’t hold your breath…

Never.

But it already is

those four oblasts are looking awfully annexed for a “failed annexation”